End-to-end fundraising for early to growth-stage startups.

Strategic comprehensive advisory for acquisitions and exits.

Enabling partial liquidity via structured secondaries with credible buyers.

Raising Capital for VCs, PEs & Institutional Fund Managers.

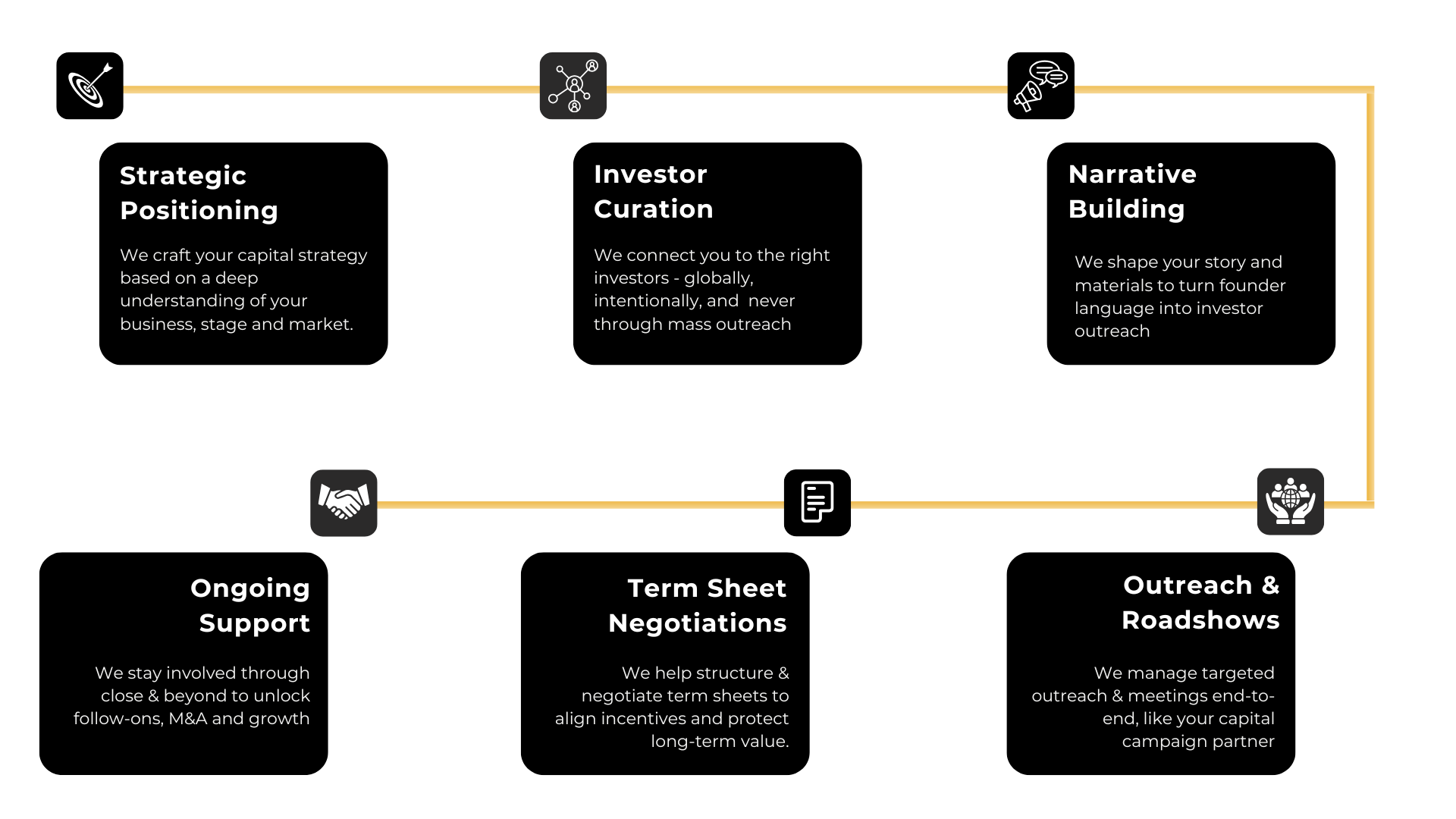

We tailor your capital strategy around your traction, vision, and market timing.

We identify the right investors based on stage, sector, thesis, and strategic fit.

We refine your pitch into a compelling story investors can believe in.

We manage focused outreach and investor interactions end-to-end.

We help secure capital on aligned terms and long-term fit.

We stay involved post-close, driving growth, follow-ons, and strategic value.